Verizon's FWA business loses some steam in Q1

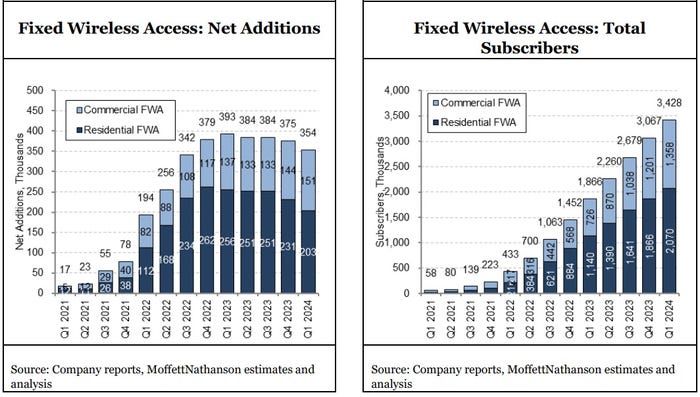

Verizon added 354,000 fixed wireless access (FWA) customers in Q1 2024, ending the period with 3.42 million. Record additions of business FWA subs were offset by a slowdown in the residential category.

Verizon continued to tack on fixed wireless access (FWA) customers in the first quarter of 2024. However, the rate of growth in the consumer segment slowed from the year-ago quarter.

Verizon added 354,000 total FWA subs (residential and business) in the quarter, versus adds of 393,000 in the year-ago period. Verizon ended Q1 with 3.42 million FWA subs.

The company posted a record 151,000 new business FWA subs, for a total of 1.35 million. It also gained 203,000 residential FWA customers, down from a gain of 256,000 in the year-ago period.

Verizon's overall FWA results "remain a puzzle," MoffettNathanson analyst Craig Moffett explained in a research note (registration required).

"Growth [in FWA] is still relatively strong, but their quarterly results continue to decelerate, something we wouldn't have expected given the early stage of their Band 76 C-Band footprint," he noted.

Still, Verizon's FWA offering continues to provide a solid alternative to cable broadband in the residential segment, despite some "muted activity," CFO Tony Skiadas said on Monday's earnings call. "We continue to be comfortable with this pace of [subscriber] growth."

Turning to wireline, Verizon added 49,000 residential Fios Internet customers, down from a gain of 63,000 a year earlier. Verizon ended the quarter with 7.02 million residential Fios Internet subs.

With DSL losses included, Verizon added 36,000 wireline broadband customers in the period, extending its total to 7.22 million.

Verizon's consumer trends across Fios and FWA are a preview of slower market growth in broadband that will be a theme as other service providers issue quarterly results, New Street Research analyst Jonathan Chaplin said in a research note.

ACP impact

Verizon said it saw some "headwinds" as it halted enrollments for the Affordable Connectivity Program (ACP), which is on the verge of shutting down in the absence of new funds. In response, Verizon announced it will discount its "Verizon Forward" offering in a way that effectively makes services free for six months for customers who are enlisted in the program.

Verizon's ACP exposure skews to prepaid wireless. New Street Research estimates that the company has 1.4 million wireless ACP subs, and about 200,000 broadband subs on the program. New Street analyst Jonathan Chaplin estimates that the company could lose about 400,000 of its prepaid mobile lines and about 25,000 broadband subs in Q2 and Q3 of 2024 should ACP wind down.

No appetite for open access models

Verizon currently does not have much of an appetite for pursuing open access models, such as the one being pursued by Gigapower, the AT&T-BlackRock fiber-focused joint venture that is building networks to about 1.5 million locations outside of AT&T's legacy wireline footprint.

Verizon Chairman and CEO Hans Vestberg said the company will evaluate open access opportunities as they come up, but stressed that Verizon has yet to find one that provides an attractive return on investment.

Turning to video, Verizon lost 68,000 residential Fios video subs, narrowed a bit from a year-ago loss of about 74,000. Verizon ended the quarter with 2.88 million residential Fios video customers, down 8.8%.

The company sidestepped a question related to a rumor that Verizon has discussed partnering with Disney on next year's planned launch of a direct-to-consumer version of ESPN.

"I think we are using our base of distribution to actually work with all of the streaming services," Vestberg said.

For now, Verizon has been focusing on +play, an initiative that helps customers manage a range of subscription streaming services, including Netflix, ViX, Max, Paramount+, Starz and AMC+, among others.

About the Author(s)

You May Also Like