US broadband subscriber pace slows across the board

Fixed wireless and fiber subscriber growth slowed in Q1 2024, creating a supposed positive trend for US cable. However, cable broadband losses accelerated in the quarter amid slower housing formation and a halt on ACP enrollments.

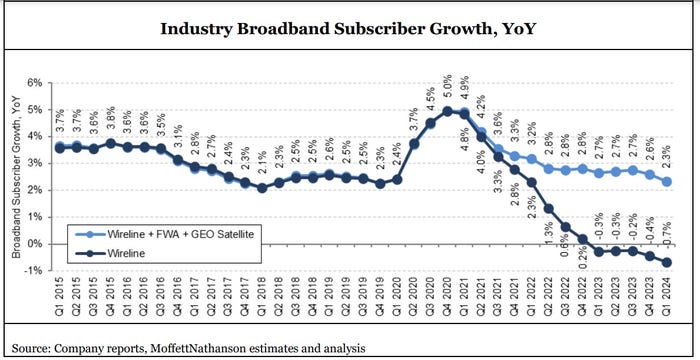

The pace of US broadband subscriber growth slowed considerably in the first quarter of 2024 as fiber, fixed wireless access (FWA) and cable broadband service providers collectively turned in results that were worse than what they posted in the year-ago period.

Total industry net additions, including or excluding FWA and geosynchronous (GEO) satellite broadband providers, decelerated noticeably in Q1 2024. The total market's growth rate dropped to just 2.3% year-over-year, the slowest since the COVID-19 pandemic, MoffettNathanson estimated in its latest broadband industry trends report (registration required). When FWA and GEO satellite categories were excluded, the growth rate was much worse: -0.7%.

When measured in subscriber units, the overall US broadband market decelerated by 299,000 net adds versus the year-ago quarter, "the most abrupt since Q2 2022," MoffettNathanson analyst Craig Moffett explained.

A mix of drivers

Moffett believes the trend is partly attributable to sluggish housing formation, with Census Bureau data indicating that occupied households in the US contracted by about 311,000 units in Q1 2024. The analyst acknowledged that the Census data is historically unreliable, but still believes that housing formation undoubtedly slowed in the quarter.

The overall broadband market is also becoming increasingly saturated by the quarter. Moffett believes the likely demise of the Affordable Connectivity Program (ACP) shares in the blame (new enrollments stopped in February), even if it becomes a one-time event that the US broadband industry will have to absorb.

"The bottom line is that penetration of home broadband stalled, and perhaps even declined in the quarter, particularly if one adjusts for the growth in homes passed in rural areas under RDOF [Rural Digital Opportunity Fund] subsidies and unsubsidized edgeouts," Moffett wrote.

FWA sub growth passes its peak

Among categories, it's becoming clear that FWA subscriber growth has peaked. US FWA providers added 879,000 subs in Q1 2024, down from a gain of 925,000 in the year-ago period. AT&T saw a sharp increase in FWA subs in Q1, but AT&T is using its relatively new FWA product, Internet Air, to capture DSL subscribers and to reach into markets where fiber's not available. Thus, AT&T is using FWA far less aggressively than are T-Mobile and Verizon.

Fiber net adds also slowed – from 487,000 in Q1 2024 versus a gain of 517,000 in the year-ago quarter. DSL losses of 560,000 in Q1 were similar to a year-ago loss of 571,000.

Those trends would supposedly be good news for US cable operators. However, cable operators shed 169,000 broadband subs in Q1, much worse than a year-ago gain of about 71,000 subs.

"The culprit for Cable's weaker broadband net additions was a slower market growth rate," though the aforementioned lower new household formation and cessation of ACP enrollments in the quarter also played a role, Moffett noted.

About the Author(s)

You May Also Like